Basic Math for eBay Sellers

Basic Math? But I already know how to add and subtract!

Basic math for eBay sellers is my way of talking about "Running Your Numbers". Everybody tells new (and even not-so-new) eBay sellers to "Run The Numbers", but just what does that really mean? And what about online sellers on other platforms - do they "Run The Numbers" the same way? Do "Brick-n-Mortar" sellers have to do this, or is it special to online selling? And why should I care?

What it does mean will depend on your goals, but what it can mean is the difference between making a profit and absorbing yet more losses. Now, maybe you don't mind handing over your hard-earned money to everyone with their hand out, but I do!

Some of what I have to show you is "Duh!" basic -- things that even a kid with a lemonade stand should know. Some may be things you probably haven't thought about much, or thought didn't apply to you. And they may not -- today. But just as my online selling has changed over the years, perhaps yours will too.

The Disclaimer

(or: you knew there would be one!)

Before we start, let me preface this entire lens by saying that I am NOT an accountant, a lawyer, or have any special financial training. I'm just a guy who's been thru this a few times and thought y'all might like the benefit of my mistakes. My goal is not to define to the nth degree, but rather to get you to wonder, to ponder, to think for yourself. Use at your own risk. Your mileage may vary. And the contents of this lens are subject to change as I determine more things that need to be considered!!

Breaking It Down

(or: does everything cost me money?)

Your selling costs will break down, in general, into a few broad categories:

- Product Acquisition. What does it cost to get your product into your hands?

- Processing/Warehousing. What does it cost to inspect, process, and store your new, and not-so-new, inventory?

- Selling. What do you pay to make your product available to the buying public?

- Product Delivery. What does it cost to pull, pack, and ship your product to a buyer?

- Returns. What does it cost you to handle a return?

- General Overhead. What does it cost you, month after month, just to be?

When you take the time to think about it (and every seller should), you'll find that we all, as sellers, have expenses that would fall into these categories. If you are lucky enough that your storage needs are basically a shoebox or two, more power to you! But we all spend time acquiring products (or suppliers), getting our products listed for sale, dealing with the sale itself, and hopefully not too many returns. Accounting for what you are doing and how it impacts your bottom line could change your bottom line - for the better!

Financial Organization Tools available on Amazon

The better you are at tracking and categorizing your expenses, the better you'll be at controlling costs. Check out a few of the selections I found in a quick search of Amazon:

Accounting Stuff on eBay

eBay can also be a good place to find similar software - here are a few of the selections I found there:

Acquisition

(or: getting inventory into your possession)

"Acquisition" is just a fancy way of saying "getting stuff to sell". This ranges from hitting all the yard sales in town to placing a standing order with a manufacturer - and anything, and everything, in between.

The math involved is pretty simple for most of us, and only a bit more complicated for the rest. So let's start with the basics and move up from there...

- Cost of the product..

- Cost to have it delivered to you.

And that's pretty much it! Like I said, for most of us, it's pretty simple.

Now here's the fun part... that 'cost of delivery' can be many things... the allowed mileage deduction when traveling from yard sale to yard sale (or to your client's warehouse, or to a trucking firm depot, etc)... delivery surcharges imposed by the carrier that were not part of the supplier's invoice (some trucking firms will charge non-dock deliveries for the hassle of unloading off the back of the truck, or for having to transfer from a semi-trailer to a smaller truck for residential delivery, etc)... import duties/taxes not paid by the supplier... etc. These are all costs that have to be accounted for when determining what it is going to cost you, per item, to put that product on your shelf, available for sale.

Obviously, the more information you have BEFORE you make your purchase, the better. Why? Because this is going to be the largest part of your base selling price calculation. This is the 'cost to replace' for this item -- when you sell one, you may want to purchase more so you can continue to sell them. Or not, as the selling price may not be worth the work. But if you don't have this very basic cost figure, you won't know exactly how much profit you made and whether it was worth the effort.

If you are buying locally (yard sale, local wholesale, retail closeouts, etc), your costs are easier to track. If you are ordering in larger lots or buying on a scheduled delivery basis, it may take a bit more work. But whatever your level, having these numbers is very very good - and your accountant will agree when it comes time to do your taxes! :)

From My Past: My inventory has largely been either items I already owned and no longer needed or consignment inventory. While the items I owned were readily at hand, I still wanted/needed to separate them from the stuff I was still using. So my 'acquisition costs' for those items was the time spent finding them and setting them aside with my other incoming inventory.On my consignment inventory, acquisition costs were determined differently -- I had mileage & labor expenses involved with pickup up this inventory from my client's dock and transporting it to my rented 'warehouse' space, but I also had a product cost as well. It's just that the product cost was calculated as the net amount remaining of the selling price after fees and commission were deducted. Keeping track of these costs was critical -- if I wasn't tracking it accurately, I could be over-charging my client for the fees, or undercharging them (and paying the balance from my own pocket!).Acquisition costs will depend on how you acquire your inventory - so track all costs related to finding and purchasing your inventory. It's better to have records you don't need.... that to find you need records you don't have!

Processing/Warehousing

(or: now that you have it, what are you doing with it?)

Processing and warehousing means more than just stuffing new inventory on the shelf...

Processing means time spent checking newly received inventory, be it yard sale finds, consignment inventory, or inventory delivered, with the express purpose of ensuring that what you have is what you purchased. Those who can inspect before buying have a leg up at this point -- you've already inspected (or should have) before buying. Consignment inventory needs to be checked for items that clearly will not sell and therefor don't need to be handled further. Purchased inventory should be counted and also inspected, to ensure you received all you paid for.

Once verified, the inventory also needs to be warehoused. This means stored, in an orderly and controlled fashion, labeled for easy retrieval when needed. New inventory needs to be kept separate from that already processed (imaged and listed) for easier access when time for those functions. All inventory needs to be stored in a way that will not contribute to aging, dust/dirt accumulation, or otherwise damaged and rendered unsellable.

What does all of this have to do with your eBay Math? Time and Money... you may not be paying someone to do this for you yet, but you may be some day. And it's always good to know how much time you are spending working, to determine if you are making a livable wage for all your work (profits over time = hourly wage). And storage is not free. Depending on what you are storing, you may be looking at racks or shelving of some kind, boxes, bins, or other containers, labels, and let's not forget the space itself - floor space, that is. You may start out using a corner of the basement, a couple racks in the garage, or a spare bedroom. But as we know - things expand to consume all resources allocated to them, and more.

From My Past: Processing and Warehousing were probably the two largest costs I had outside of actual product cost.For my personal items, processing meant trying to recall why I had set them aside, or determining if I could retest them before listing. Warehousing was mostly keeping track of what had been listed, what needed to be listed, and what I still wasn't sure about.For my consignment inventory, processing meant going thru hundreds of pairs of shoes each week, determining which brands/styles to try and sell and which to simply send back, and then separating those needing pictures from those that did not. Warehousing was more problematic - I started out with just a stack of boxes in the middle of my garage, but that proved to be too difficult to locate a given pair that had sold. So I rented some self-storage space... initially just a single 10x20 space, but eventually expanding to 5 spaces and 1200 total square feet. Some space was incoming inventory to be processed, some was inventory in process, and the bulk was for inventory that had been listed and was awaiting a buyer. Add to that the cost of shelving units, rack storage units, locks for each storage space (better to have many locks with a single key!), and even things like lighting (replaced the incandescent with CF bulbs and added a few more on cords with aluminum reflectors).

Time, resources, space. These are the expenses to be considered as part of processing incoming inventory and warehousing it.

Imaging

(or: there's more to it than just taking a couple quick snaps)

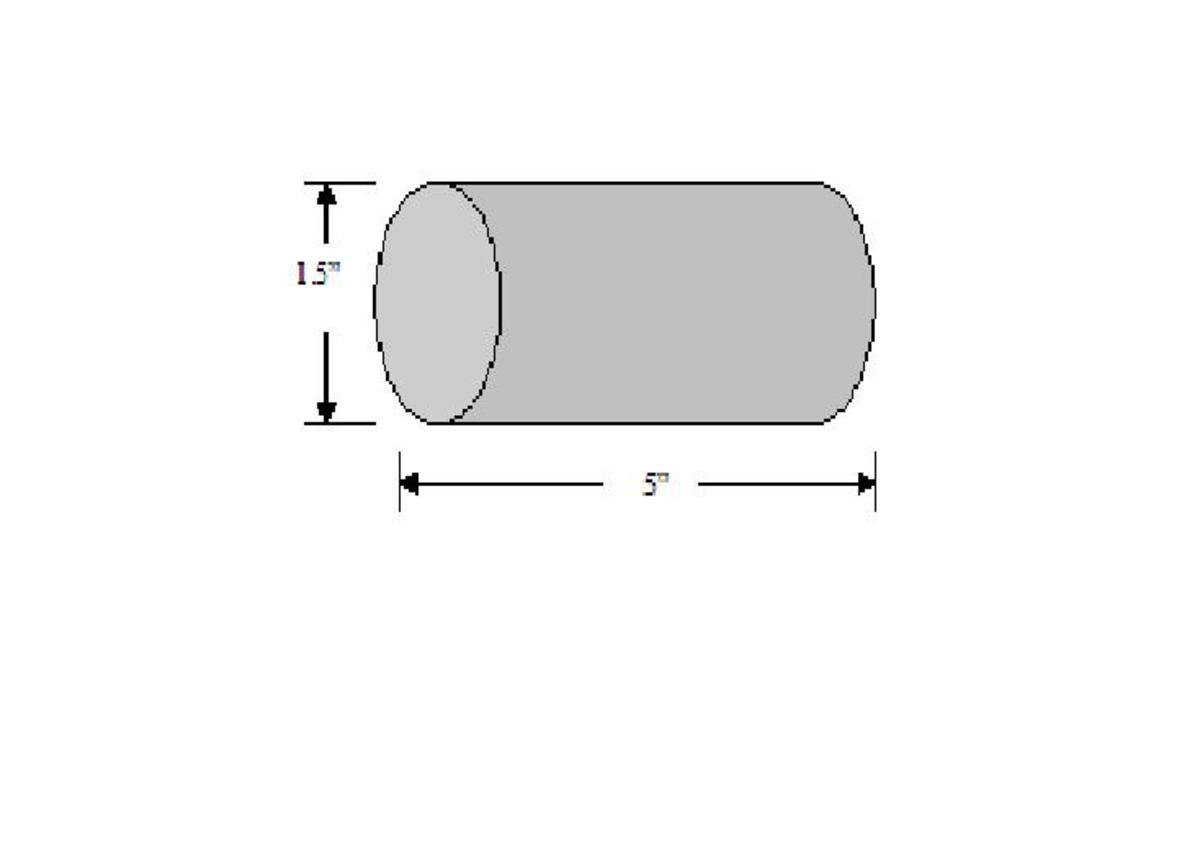

Imaging math breaks down to two things -- the cost of your camera and setup, and the time expended per item to take, edit, and upload your images to an online image server. Camera and setup costs are generally one-time, or very infrequent. Time to take/process each image, that's a lot more common and impacts your schedule as well as your pocketbook. Let's take a look at these two categories:

- Camera and Setup - Your camera is the single largest expense you are likely to have when it comes to imaging. Invest in a camera you can easily use, that has a macro or close-up setting, includes rechargeable batteries, and a LCD display for easier image taking. Shop around - this is one item you're not likely to replace for a few years. :)

Your background/backdrop can be as simple as a clean sheet or tablecloth, or as involved as a custom designed lighting booth. You want to be able to arrange your items with no distractions in the background, so take your expected inventory into mind when looking for a backdrop. As your experience grows, you can consider adding alternate backdrops, allowing you to pick and choose based on the item.

Lighting is as easy as imaging outdoors (I recommend sunny days and staying in the shadows) for even lighting, or using full-spectrum bulbs to add to your room lighting. You want your item well lit, but without glare and with as few shadows as possible. I've personally used overhead florescent fixtures with full spectrum bulbs and two desk lams, also with full spectrum bulbs, to sidelight and cut shadows. Start with what you have and update as you can afford it. I almost never us the flash on my camera.

Image editing - the software may have come with your camera, or you can find various free editing programs online, or you may go 'top-drawer' and purchase software like Photoshop . However you acquire your image editing software, be sure you are comfortable using it and that it does what you need to be done -- basic features to look for: cropping (clipping away the excess edges), resizing (so your images fit your listing format better), and saving. Other features are nice, but these are the basics you'll likely use most.

From My Past: I already had a digital camera, so my costs were limited to obtaining a backdrop (I've had several over the years) and finding affordable editing software.My camera came with software, but I didn't find it easy to use. So I elected to purchase a copy of Adobe Photoshop Elements V2.0 from a local Target. It was on clearance, as V3.0 had already been released, and I got it for about 1/2 price. Which was a very good thing -- sales were not high in those early days, and while these expenses were deductable on my income tax forms, they still had to be paid out of my personal pocket, for the most part.My initial backdrop was a scrap piece of red felt-like material that had a 1/4 inch foam backing. The material did not reflect, did not show wrinkles, was a VIVID red, and was free. Other backdrops have been purchased, but I've tended to stay with heavier materials and that felt-like appearance. The lack of flash reflection has made taking good pictures much easier.My cameras have all been Kodaks. The first was a 2.1 megapixel - advanced for it's time. It was stolen and the replacement (courtesy of my homeowners insurance) was a 3.1 megapixel. Currently I'm still using a 5 megapixel I purchased several years ago - it has great macro capability (for small items and/or close-ups), flash control, various settings (altho I almost always use "auto"), and, after all these years, it's paid for!

My equipment and supplies were acquired and upgraded over time. I never saw the need to spend a lot of money... just to spend smart and get the most use out of whatever I had until I could afford, and justify, getting better. Better to spend the time learning to take great pictures with any camera, than to spend all that money on a super camera and still not know how to use it best.

Getting Listed

(or: they can't buy it if you don't list it)

Listing/Selling fees are likely to be your largest overall expense, when looked at from a long-term perspective. So let's look at where those costs come from. And since we are talking eBay here, we'll use that model. Other sites may or may not have some or all of these fees -- adjust your math accordingly.

- Listing Fees - Listing fees are paid for each listing posted to the eBay site. While the individual fee may be as low as 2 cents, you must consider the fact that you may have to list a single item more than one before it will sell. This means that while the single listing fee may be 15 cents, you may end up listing your widget 6 times before it sells, generating 90 cents in total listing fees. This is why experienced sellers recommend doing 'completed listing' research as well as basic pricing research. How many widgets are being listed in a week, and of those, how many are selling? This is your sell-thru rate (STR) and average selling price (ASP), and give you a starting point for determining your total fees.

- Selling Fees - Selling fees may only occur once per sale, but they are more costly, and definitely must have a place in your overall profit calculations. With Fixed Price listings, determining the selling fee is much easier. For Auction format listings, you need to research your ASP and use that figure when determining your estimated selling fee. If your item sells for more, your fee does go up... but you are getting more for the sale as well. If the item sells for less, the fee will be less... and you need to try and determine if the ASP is falling or if this was a one-time event.

- Listing Feature Fees - I break these out separate as they really need to be evaluated carefully before being used. Some of these 'features' can be rather expensive, and if used to bring traffic to your eBay Store or a large-quantity listing, that's one thing. But using special Features for other items can be just plain foolish - they raise your costs and may not provide the traffic or increased selling price needed to justify their use.

Some sites offer one-time membership fees, with free listings after that. Others offer free listings for all members and low selling fees. Whatever your preferred site offers, be sure to check the STR and ASP for your item. While these eBay-alternate sites are growing, they still don't provide the traffic that eBay does -- so "do your math" and make sure you are listing where you will also be selling. Free listings don't do any good if you don't make any sales.

From My Past: eBay fees can be controlled. Yes, you read that right - they can be controlled. But it means you have to pay a lot of attention to how you are listing any given item, how your math works out. I found that, for the products I was selling, a combination of auction, fixed price, and (available at that time) Store Format listings worked best. My fees were manageable, and as I got better at selecting consignment product to accept for listing, my sales increased with little increase in listing fees. But I had to watch what I was doing and stay on top of fee changes - determining for myself what the impact of any change would be and then adjusting my efforts accordingly. Over the long term, the percentage of sales paid in fees to eBay & PayPal was dropping... a sign that my efforts were paying off, and worth keeping up with

Shipping and Delivery

(or: making good on the goods)

In the best scenario, the costs of shipping/delivery will be covered completely by your customer/buyer. The best way to achieve this is to control your costs/expenses. And the best way to control your costs is to know them.

The largest part of your shipping/delivery costs will likely be the carrier costs. USPS, FedEx, UPS... whichever carrier you choose, they are likely to make you pay something to deliver your package to your customer. eBay's shipping calculator currently (04/2010) includes only USPS and UPS rates, so if you want, you can use this to determine your shipping charge. And don't forget to consider adding a handling charge to cover the cost of the box, 'void fill' materials, packaging tape, and anything else used in packaging. And your time - because unless you enjoy working for free, you need to consider the cost of time (labor costs) as well. Not everyone needs or uses the handling charge feature - but it's there for a reason.

Shipping supplies should be clean and sturdy. Void-fill materials are those used to ensure your item doesn't go bouncing around inside the box during shipment -- packing peanuts, foam padding, crumpled kraft paper. I don't recommend newsprint as the ink tends to rub off easily and the paper itself packs down easily. And it's heavy, compared to the alternatives. Packaging tape should be USPS rated and should be appropriate for the size/weight packages you plan to use it on. Check with your supplier if you are unsure. Tape 'guns' are a good investment if you plan to package a lot of items - the time/frustration saved are well worth the investment.

Additional shipping supplies would be things like "Fragile" labels, address labels, a box-cutter/knife (useful when unpacking those incoming shipments), and anything else you would reasonably use when packaging.

When considering total shipping costs, you -could- determine the cost per inch for tape, the cost per cubic measure for your void-fill, the cost-per-label, etc. Or you could go the easier route of reviewing expenses over a multi-week or multi-month period, determine how much was used in that time, and average your costs that way. This is more effective when all or most of your shipments are of a similar size. I personally would review my shipping costs and stated shipping charge every 3-6 months, depending on whether I'd noticed price increases during that time. If the cost of boxes or packing peanuts would rise, I would review what I'd used/spent and then adjust for the new pricing of supplies and determine if I needed to adjust my charge.

From My Past: One thing you may find, as I did, is that as your volume goes up, some of your costs will go down. I was able to negotiate a discount from FedEx Ground due to my volume (not a big one, but it easily offset the cost of scheduled pickups and part of the fuel cost adjustments), and as my supply needs increased, I was able to obtain volume discounts from that supplier as well. Don't be afraid to ask -- the worst that could happen is they say no.

I also used automation to help lower my shipping time and costs. FedEx provided me with software that ran on my computer, pulled data from my Blackthorne database for each shipment, and printed thermal labels (I bought the printer, FedEx supplied the labels) for each shipment. This saved a LOT of time over filling out forms and printing labels by hand! PayPal also can print USPS and UPS shipping labels, and I know they discount the Priority Mail rates and may discount others. Search out these small savings -- add them together and you're bound to notice on your bottom line!

Refunds, Returns, and Exchanges

(or: you know it's gonna happen)

Everyone dislikes returns refunds, and exchanges. Buyers dislike the hassles of having to send something back (they don't pack/ship on a regular basis, so it's a hassle). Sellers dislike the loss of income and the opportunities for fraud. But to assume that they will not happen, just because you dislike dealing with them, is unrealistic.

So plan ahead. Plan for the fact that returns will happen, refunds will have to be made, and exchanges will be requested. Be realistic. Be flexible. And above all, be pleasant and pro-active when dealing with your customer. From my personal sales experience, I found that a very good percentage of customers who returned a purchase were comfortable enough to buy again from me. Several even stated that my handling of their request was a big part of their decision to try/buy again -- knowing that I would work with them and accommodate them without hassle made their subsequent buying decision easier. And that should be the goal of planning for returns -- making them a positive part of your customer's buying experience, so they will return again, secure in the knowledge that they will be happy or you will make it right. As a side note - happy customers tend to bid higher on auctions. :)

Costs will be primarily time (emails, handling the package when returned, re-inspecting the returned item, etc) and the refund itself. In most cases, the buyer should pay the return shipping. If the item was damaged in transit, contact your shipper on how to handle the return, provided you insured the package. If the wrong item was shipped, you should reimburse the buyer for return shipping as well. My policy on return shipping was simple -- if I messed up, I paid the freight. Otherwise the buyer paid return shipping.

Note that if the buyer files a claim with eBay or PayPal, in nearly all cases, they will be required to return the purchase to you before the refund will be considered complete. It's best if you can deal with your customer directly, without involving eBay or PayPal, but some customers will 'jump the gun' and file the complaint without ever contacting you. So you need to communicate your policy on returns with your customer at every opportunity - in the listing, in all follow-up emails (which should be via eBay Mail for traceability), and on whatever communications you insert in the package when you ship (you -do- use a packing slip, don't you?). Be pro-active when it comes to communicating with your customers -- keep them informed every step of the way!

From My Past: I don't feel that accounting for returns, refunds, and exchanges is part of the item cost - it's a overall inventory cost that is more easily tracked at that higher level, rather than trying to track it item by item. If you use tracking on your shipments and insurance when appropriate, your losses to damage or 'lost' shipments should be minimal. My return rate, for any reason, averaged slightly more than 3% and never exceeded 5% that I can recall, on a monthly basis. Meaning that for every 300 sales I shipped, I'd expect 9 or 10 of them to be returned under my "no hassle" returns policy, and I seldom saw more than 14 or 15 in any given month.

Some will say that the rules have changed, that buyers are more likely to buy with no intention of keeping the item. Well... that's always been part of selling, online or 'in the real world'. If it wasn't, why does Wal-Mart have such a large Returns area? You don't have to be a doormat... but don't be naive either - plan ahead how you will handle your returns and refunds, and do your best to limit both.

General Expenses

(or: everything else that doesn't seem to fit elsewhere)

This is where it gets interesting. :) "General Expenses" is one of those 'catch-all' categories that things get dumped into when you don't know exactly where else to put them. Talk to your accountant -- some expenses are legit and they can help you determine how to report them properly. Others may not be considered 'expenses' by the IRS, and since the goal of tracking expenses is to offset income and reduce your taxes (personal income and business alike), you will need to consider IRS guidelines when considering expenses.

A good rule of thumb is to keep all your receipts, document what the item purchased was to be used for, and keep track of whether it was disposed of (when consumed), sold (when no longer needed), or recycled (similar to sold, only no money received). It's easier to discard what you don't need (can't deduct) than it is to lose a deduction because you can't find the receipt. :)

- Some of the 'general expenses' I had were:

- Rental Space. Zoning laws meant I couldn't keep my inventory in my home, so I rented space to store it.

- Shelving/Storage Racks. Had to have these to keep my inventory visible and at hand.

- Computer Equipment. What I had was OK for personal use, but when I started selling on a regular basis, I upgraded to a more powerful system for business use.

- A Digital Camera. Already had one for personal use, wanted a better one (eventually) for taking business use.

- Backup Device and Media. I didn't want to have to rebuild everything from scratch, so regular backups were a must.

- Computer Software. This included PC operating systems, image editing software, listing management software, etc.

- Internet Service. This include -part- of the monthly service fee for my home internet connection (I worked from home), plus the cost of establishing and maintaining my business web presence and the alternate URLs as well.

- My Accountant. Didn't use him prior to establishing the business, and he was retained to answer business-related questions.

- Mileage. Keep a detailed log and deduct every mile possible. Your accountant can help you determine what's allowed and what's not, and how to track/report them.

- Phone Service. I had a 'land line' for personal use -- so my cell phone was listed as my business number.

- Insurance. Not on the packages, on the business property and assets. You could also include any business-specific insurance, such as liability coverage, in this category.

- Business Fees and Taxes. That "LLC" on my business name costs me $300 a year (state-required filing/renewal fee), plus I paid business tax on properties owned by the business and on sales, as well as sales tax on all in-state sales. All are valid deductions against the business earnings.

From My Past: General Expenses was in some ways the hardest area for me to control and the easiest. It's easy to simply not purchase that new storage rack, opting to purchase used instead. But it can also be difficult to remember to always save our receipts, to always log your vehicle mileage, to keep track of meetings with clients and all that. But it's something that will return value, in the form of deductions to lower your taxable income and therefor your taxes paid. And it's just good business practice.

So what do you think - did I do a good job? Does this all make sense? Is this information you can use? Would you like me to create more lenses of a similar nature? Curious minds (like mine) want to know! :)

![Quicken Home & Business 2011 - [Old Version]](https://m.media-amazon.com/images/I/41rfCjyajmL._SL160_.jpg)

![Sage Peachtree First Accounting 2011 [OLD VERSION]](https://m.media-amazon.com/images/I/41VRzwlEVUL._SL160_.jpg)